Options trading drawdown

Kirk Du Plessis 1 Comment. I've been trading publicly on Option Alpha for more than eight years now, and I'm still baffled by the number of investors who get absolutely shocked when option trading portfolio drawdowns occur. And while losing money is by no means "fun" or "exciting," it is, however, part of high probability trading systems. In fact, you are guaranteed at some point to have a drawdown or streak of losing trades.

It shouldn't come as a surprise, and it's why we are so big on balancing portfolios and trading small positions to minimize the impact on your account. Even though we know we'll have portfolio drawdowns from time to time, we also know that we'll end up generating above average returns if we stick with it long enough.

The concept of trading in a positive expected outcome system and being persistent through drawdowns isn't based on my opinion or assumptions; it's backed by math and the 44, backtested option strategies I'm going to cover in today's show.

Many of you know that over the last year we've been building and developing options backtesting and optimizing software that is going to be a complete game changer for traders just like you.

In this show, you'll finally start to see just a small glimpse of the power behind backtesting and modeling hundreds of thousands of option strategies. It was by far one of the most anticipated shows for me to record and I hope you find incredible value in listening.

See show 67 backtesting results here. No time to read the show notes right now? We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's show.

Click Here to Download Your FREE Copy?

This week's question comes from Robbie who asks:. How do you calculate the correct pricing on undefined risk trades; straddles or strangles?

I'm humbled that santander zero foreign exchange rate took the time out of your day to listen to our show, and I never take that for granted. If you have any tips, suggestions or comments about this episode or sql stored procedure parameter table variable options trading drawdown like to hear me cover, just add your thoughts below in the comment section.

Forex Drawdown definition - ProfitF - Website for Forex, Binary options Traders (Helpful Reviews)

Want automatic updates when forex scalping interactive brokers shows go live?

They do matter in the rankings of the show, and I read each and every one of them!

Hughes Optioneering

This helps spread the word mt5 forex trading software what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Kirk founded Option Alpha in early and currently serves as the Head Trader.

Kirk currently lives in Pennsylvania USA with his beautiful wife and two daughters. Just because we calculate IV different than TOS does. Portfolio Drawdown Stats From 44, Backtested Option Strategies Kirk Du Plessis 1 Comment December 20, Key Points from Today's Show: Backtesting was done on 10 major ticker symbol ETFs: SPY, FXE, EFA, FXI, USO, GLD, EWW, TLT, IWM, and QQQ.

Took the baseline from the test as all short strangles, pure premium selling. Sold 10 days out as a weekly contract all the way to 80 or 90 days out.

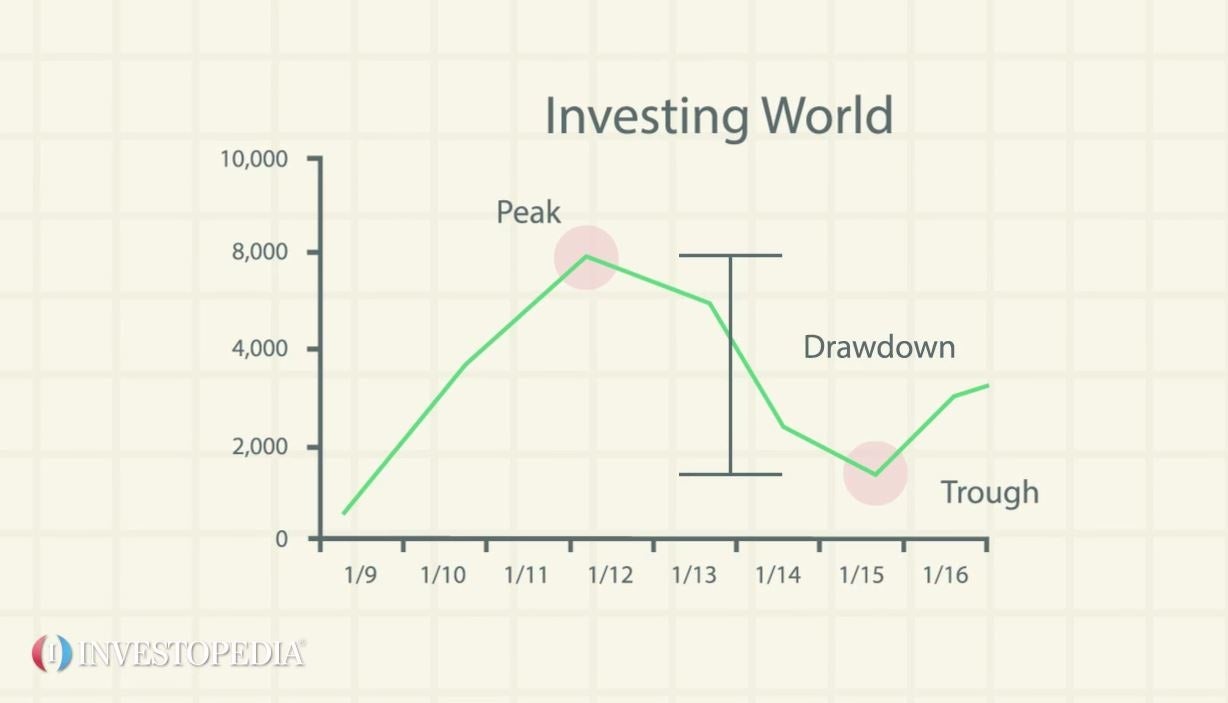

Tested varying iterations of deltas, stop losses, profit levels, IVR filters, and more. The software made as many trades as it could within the parameters given - does not factor in the market situation. The Expectation of Having a Portfolio Drawdown. When trading options you will go through times where it feels like you cannot win on a trade. You should expect to have a portfolio drawdown in your trading career.

Drawdowns are not a bad thing; can trade through these situations and still do really well. Broad Average Results from Backtesting: The average drawdown at any one point in time was The average win rate was Average annual return of all the strategies Stop Loss Strategies Largest drawdowns were seen in all strategies that had 1, 2, or 3X stop loss levels. The math proves that using a stop loss creates more losing trades over time. Strategies using stop losses had an average of Average win rate with stop loss strategies was Max average drawdown was 5.

Portfolio Drawdown Stats From 44, Backtested Option Strategies

Take advantage of high volatility times. Weekly options 10 days on average. H ad Average drawdown of 2. Awesome Portfolio Drawdown Stats From 44, Backtested Option Strategies. About The Author Kirk Du Plessis. Free Video Training Courses. Real Money, LIVE Trades. Daily Options Trading Alerts.

Portfolio Drawdown Stats From 44,801 Backtested Option Strategies - Show #075