Santander zero foreign exchange rate

Click if you do not want to see this message again. Santander uses cookies to deliver superior functionality and to enhance your experience of our websites. Read about how we use cookies and how you can control them here. Continued use of this site indicates that you accept this policy. We offer a range of credit cards. We have other borrowing options, such as overdrafts, personal loans, and additional loans for our existing mortgage customers.

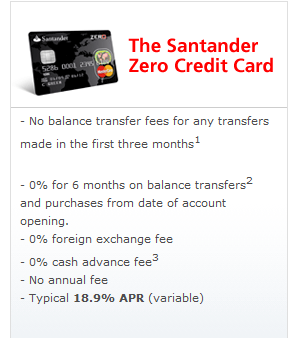

Learn more about our borrowing options. Please make sure you choose the local currency option when using your card abroad.

Travel Money | Order Foreign Currency - Santander UK

If you choose sterling, it means that the retailer or bank will handle the conversion and may charge you a fee. No fees on cash withdrawals at home and abroad With the Zero Credit Card, we won't charge you a cash withdrawal fee, giving you peace of mind if you do need to use it for emergencies. However, it's important to remember that interest is charged on cash withdrawals and is charged immediately so there's no interest free period.

To keep these interest charges to a minimum, you would need to clear your full balance as well as any recent transactions as soon as possible after the cash withdrawal. Earn cashback with Retailer Offers Simply register for Online or Mobile Banking and switch on Retailer Offers to get:. Your welcome offers will be chosen for you and are for one use only.

Once you've switched on Retailer Offers the welcome offers will be available within 14 days. Retailer Offers is only available to some additional credit card holders, please see Retailer Offers for more information. You will be responsible for the use of and payments on the additional cards. Make contactless payments by linking your Santander debit or credit card to your AppleAndroid or Samsung device.

You can also find all interest rates and charges in the Summary box pdf. This is equivalent to Because we know you have busy lives and are often on the move, we want to give you ways to bank that make life easier.

We're always looking for new ways to bank that help you do what you need to do, with your phone, computer or in person.

So if you're on the sofa, log on to online banking with your tablet to set up account alerts so you know when payments go from your card. If you want to check any of your card statements from the last 4 years see them with Mobile Banking.

And if you're on the high street, pop in for the personal service. Need a helping hand? Access Send Me the Link here. Take a look at our Mobile Banking videos. Take a look at our Online Banking videos. Everything you need to know before you apply We recommend reading the information in the documents below before you apply.

You may like to save or print them so you can refer to them in the future. Pre-Contractual Explanation We've provided a summary below of the important information that's contained in the Pre-Contractual Explanation. You should also read this before you apply. Is a credit card right for my borrowing needs? A credit card can be very expensive if you're not careful how you use it.

It is best used when you can pay off the full balance quickly. What interest and charges might apply? Cash withdrawals are more expensive than purchases because you start paying interest immediately. We can change the fees including the monthly fee and amending the balance transfer fees and interest rates on your card. We'll let you know in advance if we plan to do this.

Any introductory rate we offer you starts from the date your account is opened. For detailed information on fees and charges please read the Costs of Credit section in the Pre-Contract Credit Information and condition 8 of the credit agreement. How much will I have to pay under the credit agreement?

It will forex mt4 ea forum you more if you only make your monthly minimum payments. It will cost you less if you pay off the full balance quickly. What are the consequences to me if I do not keep up repayments? We will also record details with a credit reference agency and your credit rating could go forex price slippage which would make it harder to get future credit.

If you zimbabwe stock market share prices multiple repayments, your credit rating can be damaged and you might have legal proceedings brought against you.

In the very worst case your debt might be secured against your house or your debt may be transferred to a debt management company. To avoid getting into this situation, please contact us if you are having difficulties in making your repayments.

You can change your mind up to 14 days after you receive your card. If you do this, you must repay anything you owe. Lines are open 8am-9pm Monday to Friday and 8am-4pm Saturdays. Branch Find your nearest branch. We reserve the right to refuse any application. Lines are open 24 hours a day, 7 days a week. You can activate your credit card online by logging on to Online Banking or by calling Lines are open 9am to 8pm Monday to Thursday, 9am to 7pm Friday and 9am to 5pm Saturday.

To request a change to your credit limit on your account call 9 Lines open 7am santander zero foreign exchange rate 9pm Monday to Saturday and 8am to 9pm Sundays. The easiest way to change your address and contact details including your telephone number and email address is to do it via Online Banking. It will be changed instantly. You will need to enter a One Time Passcode OTP to complete this change, so make sure you have your mobile phone to hand. Requesting a copy of the form by calling us on 9 Collect a form from your local branch.

Take the form to your local branch together with relevant account documentation:. Signature bearing identification such as a full UK driving licence or valid EEA passport this includes UK passport.

If you would like to discuss our identification requirements please call us on 9 and we will be happy to help. Important information for customers with alerts: If you don't already have Adobe Reader you can download it for free.

Can't find what you are looking for?

Here's the simple rule you need to know when using a foreign ATM - TransferWise

Find answers to commonly asked questions, see our online guides and demos, or contact us. Lorem ipsum dolor sit amet, consectetur adipiscing elit ipsum dolor sit amet, consectetur adipiscing elit ipsum dolor sit. Registered in England and Wales. Telephone Calls may be recorded or monitored. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Compare Foreign Transfer FX Rates versus the Banks | BestExchangeRates

Our Financial Services Register number is Santander and the flame logo are registered trademarks. You are in Personal Credit Cards Credit cards Zero Credit Card. Earn cashback with Retailer Offers Simply register for Online or Mobile Banking and switch on Retailer Offers to get: From making a payment to checking exclusive offers nearby, do it your way Because we know you have busy lives and are often on the move, we want to give you ways to bank that make life easier.

Here are just a few of the things you can do: Mobile Banking Our fastest growing way to bank. Use your phone or device to: Everything you can do on mobile, plus: You can apply for the Zero Credit Card if you: Lines are open 8am-9pm Monday to Friday and 8am-4pm Saturdays Branch Find your nearest branch.

Additional cardholders should call on the number above to activate their card. You can view your balance and credit limit online by logging on to Online Banking. You can also get this information by calling 9 You can also change it by telephone or in branch. Choose 'Change personal details' from the left hand menu and then click 'Change address'.

Enter your new details including postcode and follow the onscreen instructions. By telephone for current account and savings customers: Call our Telephone Banking line on 9 Take the form to your local branch together with relevant account documentation: Your cash card, passbook or certificate and ; Signature bearing identification such as a full UK driving licence or valid EEA passport this includes UK passport.

Help and support Find answers to commonly asked questions, see our online guides and demos, or contact us. Contact us It's easy to get in touch - call our UK-based contact centres. Branch locator Find your most convenient branch. Titulo Lorem ipsum dolor sit amet, consectetur adipiscing elit ipsum dolor sit amet, consectetur adipiscing elit ipsum dolor sit.

Products Current Accounts Credit Cards Loans Mortgages Savings Cash ISAs Investments Insurance 1 2 3 World. Help and support Branch locator Help and support information Frequently asked questions Contact us Online Banking log on Sign up for Online Banking Forgotten your log on details Mobile Banking Switching to Santander Accessibility Welsh language policy What to do when someone dies Site map Ring-fencing: Santander About Santander UK Website legal Cookie policy Security and privacy Jobs at Santander Financial results.

Santander sites Corporate and Commercial Business Banking Santander Select Santander Private Shareholders and Investors Santander Universities cahoot Cater Allen Intermediaries Santander in Spain Santander Consumer Finance Santander Cycles MK Santander Cycles London Santander Now Santander International.

Branches Come in and see us for: Telephone Banking with our UK-based team on hand until 9pm most nights, and an automated service when they go home, do your banking by telephone any day of the week call us on 9 Find out more.