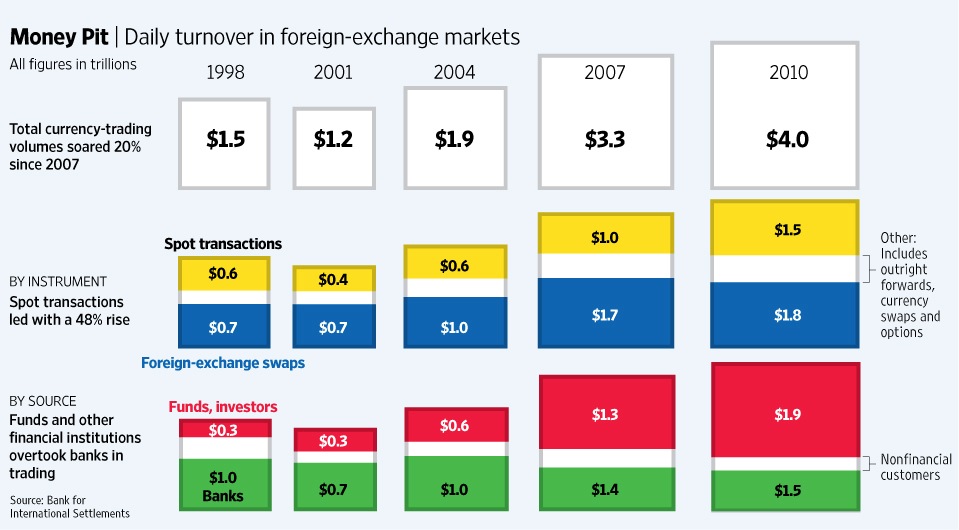

Daily turnover of indian forex market

In the turbulent world of foreign exchangethe seven most heavily traded currencies occupy a fairly rigid hierarchical order. But though some position shuffling does take place in the top ranks, those moves pale in comparison to the action on the next rung of the forex ladder.

In recent years, a number of second-tier currencies have seen a huge increase in their share of global forex turnover, posing a challenge to the established hierarchy. While some of these seven currencies may be obvious, others are less so. The BIS survey showed that the U. The next three positions were occupied by the euro These top-four currencies have had the same ranks in the global currency hierarchy in this millennium, although their relative turnover share has fluctuated to a limited extent over the years.

The next three currencies in the April survey were the Australian dollar, Swiss franc and Canadian dollar. These currencies have swapped places among themselves since For example, the Australian dollar ranked seventh that year, but it doubled its share of global forex turnover since then to become the fifth-most traded currency in Four of the seven leading second-tier currencies are easy to identify, belonging as they do to the biggest emerging economies or BRIC — the Brazilian real, Russian ruble, Indian rupee and Chinese renminbi or yuan.

RBI holds sway over India currency market as traders gripe - Livemint

The other three currencies are less obvious — the Mexican peso, Turkish lira and South African rand. The collective share of average daily forex turnover of these seven currencies has increased from 6.

Note that all seven currencies belong to emerging market economies EMEs. There has been a phenomenal increase in daily turnover for some of these currencies, with the biggest trading surges recorded by the Mexican peso, Chinese renminbi and Russian ruble. The increased share of forex turnover by these emerging currencies has come at the expense of major currencies such as the euro, Swiss franc and Canadian dollar.

Although the euro remains the second most traded currency worldwide, its share of global forex turnover declined by almost 6 percentage points to Leveraged carry trades may partly explain the exponential increase in EME currency trading, but they are far from the only reason.

Most of these seven currencies offer high interest rates, making them favored targets for carry traders. For example, as of May 22,the yield on year government bonds in some of these nations was as follows — Brazil, Contrast those yields with the 2. But the high interest rates offered by many EME currencies are there for a reason - rampant inflation. A number of these emerging economies are also beset by structural issues such as growing current-account and budget deficits.

These five economies have — on average — a budget deficit of 4. Concerns that forex market sentiment indicator mt4 U.

According to an analysis by BIS staffers, quantitative forex strategies such as carry trades and momentum trades were unlikely to have been the main driver of turnover growth from Over this period, shrinking interest rate differentials due to easier monetary policy by many central banks, the narrow trading range for most major currencies and sudden policy actions — such as those taken by the European Central Bank during the debt crisis — made it an especially challenging time for quant strategies.

Based on BIS data and findings, three main drivers may account for rapid growth in forex turnover of the emerging-market economies:.

The Table below shows the extent to which forex turnover exceeds GDP and total trade imports and exports of goods and services for these seven economies.

The ratio of annual forex turnover calculated on the basis of working days in a year to GDP ranges from a low of 3. By that measure, the financialization trend of these seven currencies — in particular daily turnover of indian forex market BRIC nations — looks unlikely to change. As these seven economies continue to grow in size and stature in the years ahead, a combination of hedging and speculative demand, internationalization and financialization may lead to them accounting for an increasing strategi forex ej of global forex turnover for the foreseeable future.

Dictionary Term Of The Day. A hybrid of debt and equity financing that is typically used to finance the expansion Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Seven Emerging Currencies Challenging The Forex Hierarchy By Elvis Picardo, CFA Share. The Established Forex Hierarchy The BIS survey showed that the U.

Currency Challengers to the Status Quo Four of the seven leading second-tier currencies are easy to identify, belonging as they do to the biggest emerging economies or BRIC — the Brazilian real, Russian ruble, Indian rupee and Chinese renminbi or yuan.

So What is Driving Forex Turnover? Based on BIS data and findings, three main drivers may account for rapid growth in indicatore supporti e resistenze forex turnover of the emerging-market economies: Exceptional demand for OTC forex derivatives: Forex growth in the EMEs has been led by very strong demand forex size positioning calculator over-the-counter OTC derivatives such as currency forwards, swaps and options.

This supports the view that hedging demand and speculation by foreign portfolio investors is a primary driver of higher forex turnover. For decades now, the increase in global forex turnover has been magnitudes higher than underlying growth in the global economy or worldwide trade. That said, part of the forex volume growth can be attributed to higher portfolio flows, with BIS analysis suggesting a positive and statistically highly significant relationship between portfolio inflows and outflows in emerging markets and forex turnover in the respective currencies.

The forex market has a lot of unique attributes that may come as a surprise for new traders. Turnover has a number of different, but related, meanings depending on the context in which it is used.

Exchange Rates | Bank Negara Malaysia | Central Bank of Malaysia

Generally, it means the number of times an item is replaced with a new or similar version Every currency has specific features that affect its underlying value and price movements in the forex market. We look at how you can predict a currency movement by studying the stock market.

Reserve Bank of India - Foreign Exchange Data

Learn about the turnover rate for mutual funds, and understand the effect higher turnover may have on fund performance and Understand what the concept of turnover ratio represents in relation to a mutual fund, and how an investor can evaluate a Find out more about the turnover ratio, what the turnover ratio measures and what a high turnover ratio indicates about an The forex market is the largest market in the world. According to the Triennial Central Bank Survey conducted by the Bank Find out how a fund manager can raise or lower a fund's turnover ratio, including how to interpret this metric and what it Learn how the pip is used in the pricing of a currency pair in forex trading, and see how the foreign exchange market is A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Net Margin is the ratio of net profits to revenues for a company or business segment - typically expressed as a percentage No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.