Monte carlo call option pricing matlab barrier

Translated by Mouseover text to see original. Click the button below to return to the English verison of the page.

This page has been translated by MathWorks. Please click here To view all translated materals including this page, select Japan from the country navigator on the bottom of this page. The automated translation of this page is provided by a general purpose third party translator tool.

MathWorks does not warrant, and disclaims all liability for, the accuracy, suitability, or fitness for purpose of the translation.

Choose your country to get translated content where available and see local events and offers. Based on your location, we recommend that you select: Contacts Comment acheter Se connecter. Documentation Home Financial Instruments Toolbox Examples Functions and Other Reference Release Notes PDF Documentation.

This is machine translation Translated by. Select Language Bulgarian Catalan Chinese Simplified Chinese Traditional Czech Danish Dutch English Estonian Finnish French German Greek Haitian Creole Hindi Hmong Daw Hungarian Indonesian Italian Japanese Korean Latvian Lithuanian Malay Maltese Norwegian Polish Portuguese Romanian Russian Slovak Slovenian Spanish Swedish Thai Turkish Ukrainian Vietnamese Welsh.

Implementation of the modified Monte Carlo simulation for evaluate the barrier option prices

Price Using Monte Carlo Simulation Price basket, Asian, spread, and vanilla options using Monte Carlo simulation with Longstaff-Schwartz option pricing model.

Was this topic helpful?

Select Your Country Choose your country to get translated content where available and see local events and offers. Americas Canada English United States English.

Option Pricing using Monte Carlo SimulationFinancial Instruments Toolbox Documentation Examples Functions and Other Reference Release Notes PDF Documentation. Other Documentation MATLAB Financial Toolbox Risk Management Toolbox Statistics and Machine Learning Toolbox Optimization Toolbox Documentation Home.

Support MATLAB Answers Installation Help Bug Reports Product Requirements Software Downloads. Determine price and sensitivities for basket options using Longstaff-Schwartz model.

Not Found

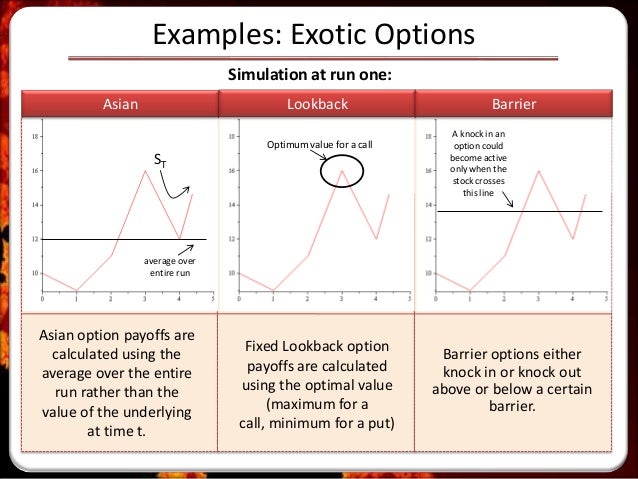

Calculate barrier option prices or sensitivities using Longstaff-Schwartz model. Calculate European or American Asian option prices or sensitivities using Longstaff-Schwartz model.

Calculate prices or sensitivities of lookback options using Longstaff-Schwartz model.

Price Using Monte Carlo Simulation - MATLAB & Simulink - MathWorks France

Calculate price and sensitivities for European or American spread options using Monte Carlo simulations. Price European, Bermudan, or American vanilla options using Longstaff-Schwartz model. Calculate European, Bermudan, or American vanilla option prices or sensitivities using Longstaff-Schwartz model.