How compounding interest works in stock market

We often hear that Albert Einstein called compound interest the eighth wonder of the world. The downside, of course, is that having compound interest working against you can be frustrating and keep you from reaching your financial goals.

When someone lends you money, they have a right to get that money back.

What Kind of Investment Accounts Earn Compound Interest? -- The Motley Fool

In terms of debt, interest is basically the surcharge for getting access to capital. Whoever provides you with that capital wants to make money on the deal, and so charges interest. You can earn interest, though, by letting your own money be used by others.

Investing in stocks, or putting your money in a savings account, are examples of ways that you offer up money to be used by others. In return for letting others use your capital, you are paid interest.

Basically, compound interest is how your money makes money on your behalf. If you invest, it means you not only earn a return on the initial amount of your investment, but also earn a return on your earnings. This is seen especially with credit cards that compound interest on a daily basis. At the end of each day, a credit card will look at your balance, figure out how much interest you should be charged, and then add that interest charge to the balance.

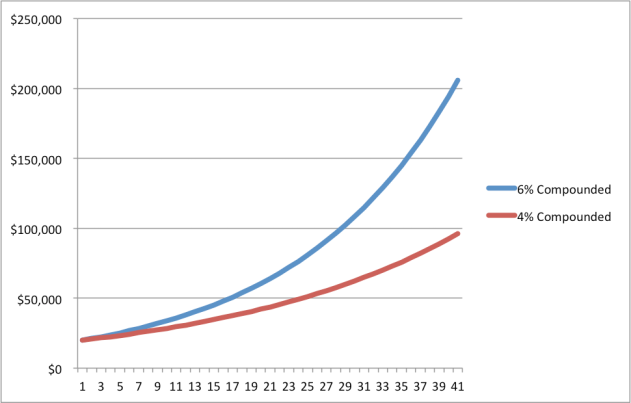

Compound interest is most powerful over time. The longer you put your money to work, the bigger the results. Of course, this also works the same way with debt. The longer you carry debt, particularly credit card debt, the more you end up paying. Below is the compound interest formula, which allows you to see how it all breaks down.

You can see more examples from DePaul University. As you can see, carrying credit card debt for a long period of time can be expensive. Over time, you would pay down the credit card, and not actually end up pay that full amount. Earning compound interest is a much better prospect, and you can really see how time matters when you look at it from this standpoint.

You can see what a difference compound interest over time makes! Of course, you get better results from compound interest if you make regular additions to your account.

If you go to Money Chimp , you can see that the formula for annual additions is:. This assumes that you make an addition at the end of each year. You can get a pretty good idea of what you could do with the help of dollar-cost averaging, though, using this formula or just doing yourself a favor and using a handy compound interest calculator found online.

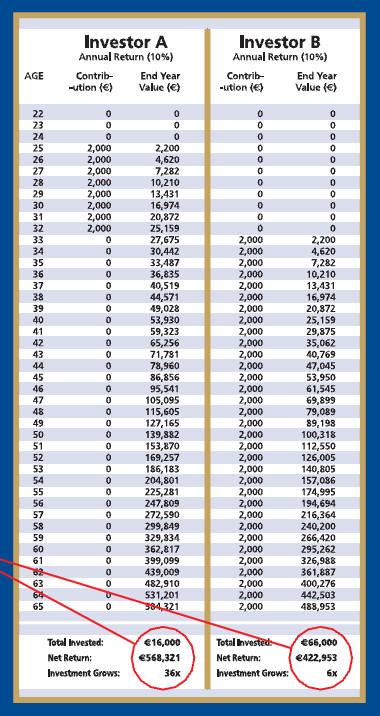

My son, for example, opened a Roth IRA this year for the earnings he has from working in my home business. Consider an average worker. As you can see, compound interest can, indeed, be a big deal. You want to be the one earning compound interest, NOT paying it.

If you want to be successful in the long run, put compound interest to work on your side, rather than paying that interest to someone else. Helping make finance easy.

Investor Junkie is your shortcut to financial freedom.

Access Denied

We know that managing finances is not easy. We analyze and compare tools to help you make the best decisions for your personal financial situation. Investor Junkie is a financial publisher that does not offer any personal financial advice, or advocate the purchase or sale of any security or investment for any specific individual.

Members should be aware that investment markets have inherent risks, and past performance does not assure future results.

In accordance with FTC guidelines, Investor Junkie has financial relationships with some of the products and services mentioned on this web site, and Investor Junkie may be compensated if consumers choose to click these links in our content and ultimately sign up for them. For more information please visit our disclaimer web page.

Start Investing Educate Investing Secrets Investing Dividend Investing Retirement Real Estate Taxes The Mint Manual Other Articles Reviews Best Investment Apps Personal Finance Microsavings Robo-Advisors Stock Brokers Peer-to-Peer Lending Real Estate Investment Research Finance Books Accounting Promotions Robo-Advisors Stock Brokers. How Does Compound Interest Work for Investments? What is Compound Interest? Learn What the Wealthy Know Sign Up for Our FREE Weekly Newsletter.

Learn wealth-building strategies to get you on the path towards financial freedom. Suggested For You The True Cost of Waiting to Save For Your Retirement 25 Most Common Investing Terms and Definitions What's Next?

The Get Rich Slowly Forums - Information

A Guide to Setting Long-Term Goals After Paying Off Debt There's No Such Thing as a "Risk Free" Investment. Make a Comment Cancel reply Your Email address will not be published. Recent Investing Articles Two Riskiest Markets to Invest In: Student Loans and Business Loans When Should You Start Investing?

What Makes Stocks Go Up and Down? Popular Reviews Personal Capital Review Betterment Review Betterment vs. Stash Wealthfront Review Overview of Robo-Advisors Motif Review Mint Review Quicken Review Stash Invest Review YNAB Review Acorns Review TD Ameritrade Promotional Codes. Stay Connected to Investor Junkie.

About Contact Advertise Privacy Disclaimer.