Employee stock option pool dilution

It brought together some of the brightest talent in the startup community from 15 countries with one of the best accelerator programs in the world and mashed it up with awesome content providers like Twitter, Facebook, BSkyB, BBC, Getty, HarperCollins, EyeEm, Nokia Music and Imagga. There were a total of 12 teams working on interesting and exciting projects. As part of this hackathon, Ali and Will helped me aggregate resources to help founders better understand the process of raising equity and the impact it can have to their founder stakes.

Valuing a company and calculation its impact on your equity is a very complex and confusing for entrepreneurs as well as being far from an exact science, this is the pain point that we wanted to address. In the words of Seedhack attendee Will Martin willpmartin.

Experience of raising a round and understanding the numbers and implications of that round and the related equity issued to an investor as well as employees in the form of an option pool is vital, but sadly is only fully understood by going through the process for real.

Our intention was to give founders the knowledge required by being able to go through the process in a simple and easy way, thus giving the founder the confidence when it happens for real.

The Option Pool Shuffle - Venture Hacks

Ali and I are first time founders currently actively looking for investment. We know the total value we need in terms of money we want to raise as well the percentage of equity we are comfortable willing to give up to the investor. Having an option pool for employees, advisors, board members etc.

This complicates the issue for the founder, so being aware of the impact of their shareholding as a result is vital for a founder as it is them that gets diluted in the first round but also any subsequent round, but it is often overlooked. The changes to equity positions of the founders, investors, employees etc. Having this knowledge now gives buy admiral shares as founders a huge advantage over other founders we are competing with for funding and bridges the knowledge gap that exists for first time founders.

Does Dilution Occur When Shares Are Granted or Exercised? | The Finance Base

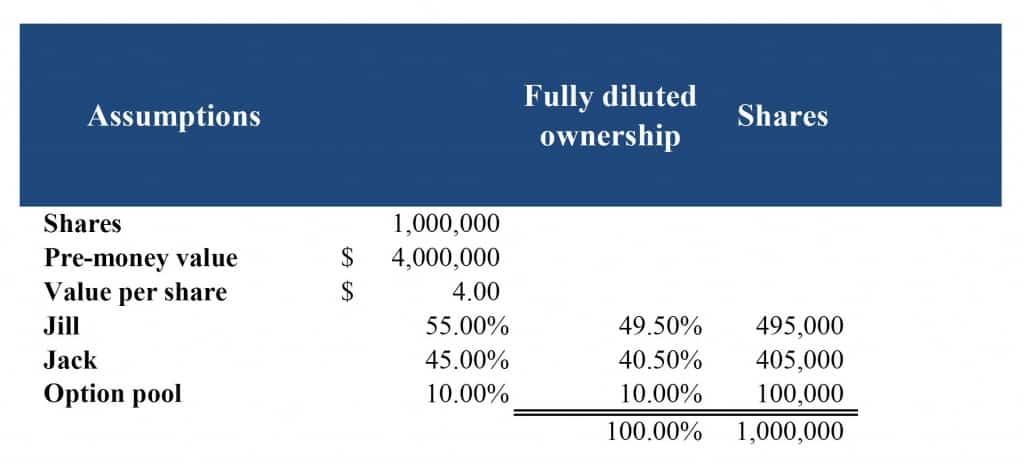

In order to read some of the terms on this cap table model, below are some definitions which you might find useful:. By establishing this valuation, it helps investors understand what amount of equity they will receive in the company in exchange for their capital.

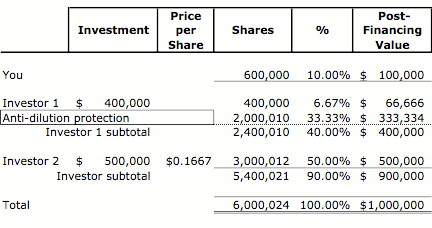

Once the financing round has been completed, the post-money valuation is the sum total of the pre-money valuation plus the additional capital raised.

Employee Stock Options ExplainedIf an investment adds cash to a company, the managed forex accounts scam will have different valuations before and research paper impact fii indian stock market the investment. External investors, such as venture capitalists and angel investors will use a pre-money valuation to determine how much equity to demand in return for their employee stock option pool dilution injection to an entrepreneur and telus stock market watch or her startup company.

This is calculated on a fully diluted basis.

A POST-MONEY VALUATION is the value of a company AFTER an investment has been made. This value is equal to the sum of the pre-money valuation and the amount of new equity.

The Post-money valuation is the sum of the pre-money valuation and the money raised in a given round.

At the close of a round of financing, this is what your company is worth well, at least on paper. The OPTION POOL is the percentage of your company that you are setting aside for future employees, advisors, consultants, and the like.

Employees who get into the startup early will usually receive a greater percentage of the option pool than employees who arrive later. This is the least founder-friendly way to present this, but it is also the point at which most early stage investors will start the negotiations.

The investment, or money is how much money is raised in a given round of financing. Howeverthe decisions and their implications surrounding this number are among the most important that a founding team makes.

Hughes Optioneering

It is not just about how much money is raised, it is about the terms that the money is raised on and, maybe most importantly, whose money it is and what they bring to the table in addition to money.

Link to the Model Cap Table: If you are considering using Convertible Notes as part of your round, check out this variant of the cap table with notes on how to convert as well: This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3. Seedcamp Your First Round Fund. Further Information Our Team Press Kit Partners In The Press Seedcamp in Numbers Privacy.

Grow With Us Upcoming Events Newsletter Business Advice Jobs Contact. Connect With Us Facebook Flickr Linkedin Tumblr Twitter YouTube. Return to top of page.