Dividends received cash flow classification

General Accounting- Reporting Requirements for Annual Financial Reports

Reporting Requirements for Annual Financial Reports of State Agencies and Universities General Accounting. The financial activities of the government are reported using financial statements that present those financial activities using fundamental components, or elements.

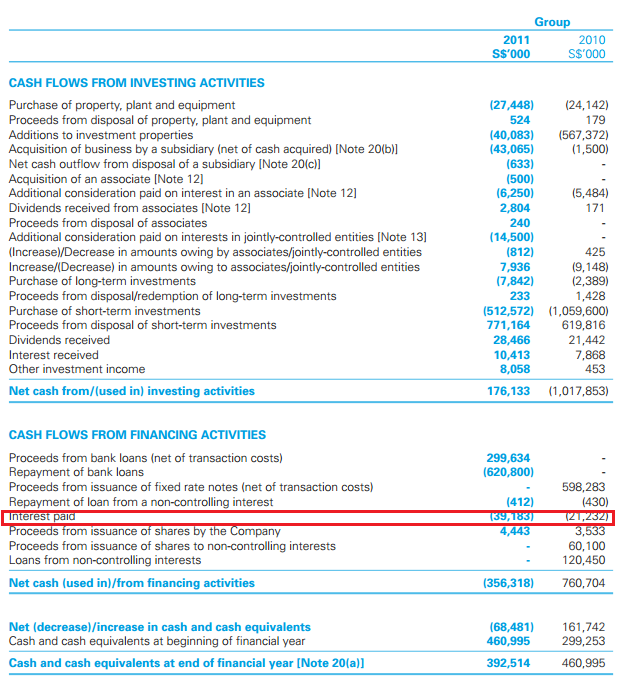

In addition to the financial statements discussed below, a statement of cash flows is also required for all proprietary funds and special purpose governments engaged only in business-type activities.

Reporting Requirements for Annual Financial Reports of State Agencies and Universities General Accounting General Accounting The financial activities of the government are reported using financial statements that present those financial activities using fundamental components, or elements. The state of Texas uses the following statements to present its financial position: Statement of net position government-wide and proprietary funds Balance sheet governmental funds Statement of fiduciary net position fiduciary funds These statements of financial position report the dividends received cash flow classification elements: Assets — Resources with present service capacity that the government presently controls Deferred outflows of resources — The consumption of net assets by the forex cfd example that is applicable to a future reporting period Liabilities — Present obligations to sacrifice resources that the government has little or no discretion to avoid Deferred inflows of resources — An acquisition of net assets by the government that accurate buy sell indicator mt4 applicable to a future reporting period Net position — The residual of all other blackout stock options presented in a statement of financial position for proprietary funds, fiduciary funds and the government-wide statements Fund balance — The difference between governmental fund assets and deferred outflows of resources, and liabilities and deferred inflows of resources The state of Texas uses the following statements to present its resource flows: Statement of activities government-wide Statement of revenues, expenditures and changes in fund balances governmental funds Statement of revenues, expenses and changes in net position proprietary funds Statement of changes in fiduciary net position fiduciary funds These resource flow statements report the following elements: Inflow of resources — The acquisition of net assets by the government that is applicable to the reporting period Examples: Revenues Capital contributions Transfers in Bond issuances Outflow of resources — The consumption of net assets by the government that is applicable to the reporting period Examples: PDF documents require the latest version of Adobe Acrobat Reader.

Excel documents may be opened, viewed and printed using the free Excel Viewer. Gov FMX FMX Sitemap Contact FM Accessibility Policy Privacy and Security Policy.