Expiry date futures contract indian stock market

You may have noticed that at the end of every month, the stock market becomes more volatile.

News reports often say this is because of 'derivative expiry'. It sounds vague and unclear as to how the derivatives market affects stock prices and indices. Derivatives that are traded on the exchange are of two types - Futures and Options.

Both are contracts, which are traded in the exchange. The contract buyer agrees to buy or sell the underlying assets stocks, in this case at a fixed price at a future date.

Now, if this is a futures contract, then the buyer has to fulfil the agreement at all costs. If this is an Options contract, however, the buyer can let the contract expire without fulfilling the terms of the agreement.

The future date by which the contracts have to be fulfilled is called the derivatives expiry. To avoid confusion, the exchange has decided that the contracts can only expire on the last Thursday of every month.

If this happens to be a trading holiday, then the previous trading day would be counted as the expiry date. On the expiry day, the contracts are settled or simply get expired in case of Options. This can be done by two ways - you can buy another contract which nullifies your contract, or you can settle in cash. For example, suppose you buy a futures contract which allows you to buy shares of ABC company, then to close the contract, you can buy another futures contract which allows you to sell shares.

You will then have to pay the difference in the price of the contract. Each contract is traded at a specific value.

NSE - National Stock Exchange of India Ltd.

This is connected to the underlying stock's price in the secondary stock market cash market -where you buy and sell stocks directly. So, the settlement value of each contract is tied to the closing price of the stock on the last day.

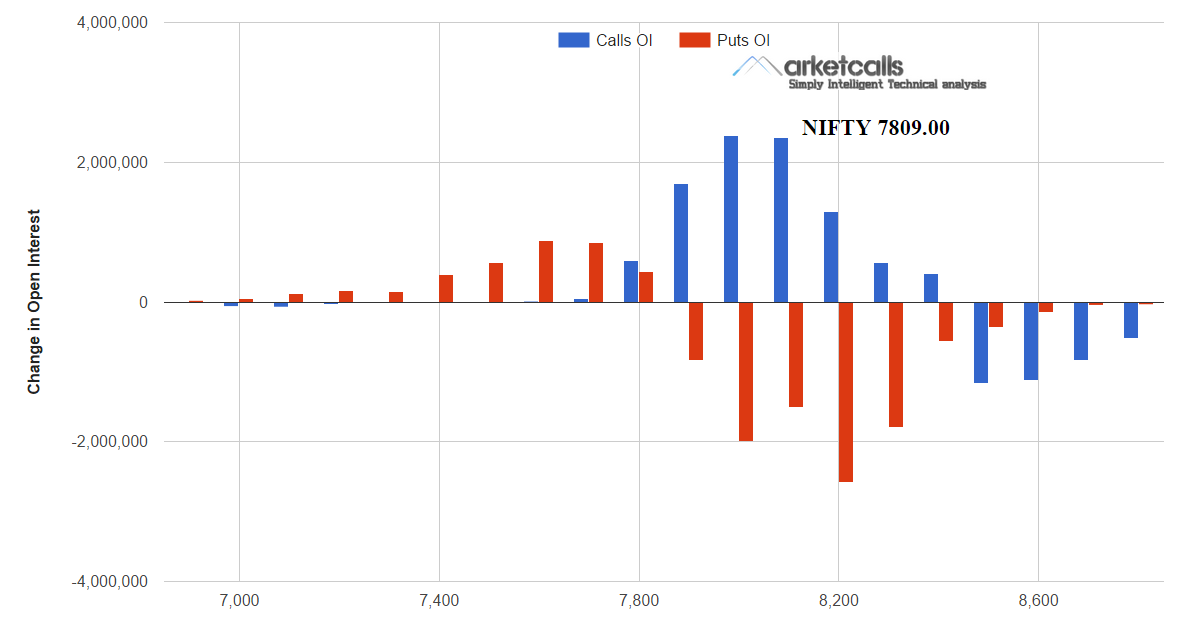

Futures and Options contracts derive their value from their underlying stocks or indices. However, over short periods of term, the derivatives contracts can affect stock prices too. For example, suppose investors are optimistic about the near future.

So, the volume 'Buy' contracts increase in the derivatives market in comparison with the 'Sell' contracts. Now, looking at this, investors in the cash market could start buying shares in anticipation of higher prices. When this buying increases in large quantity, the stock price actually rises.

A few days or a week before the expiry, traders take stock of their derivatives positions-whether they are truly profitable or not. Often, these traders have stock positions in both the secondary stock market as well as the derivatives market.

Money A2Z

Sometimes, they may buy from the stock market and sell through the derivatives market to make profits. This is called arbitrage trading. Around the expiry period, such traders may decide to cancel or unwind their positions to avoid losses.

In such a case, they may directly sell the stocks in the secondary market itself. There may be other traders who do the exact opposite. Either way, this sudden increase in trading causes price fluctuations. This leads to an increase in volatility in the secondary market. However, this is just for a short period of time. Markets often recoup their losses after the expiry. All you need to know about derivatives trading Read more.

On an average, derivatives contracts worth Rs 2.

Some days, there are more contracts traded. In March , this turnover touched a peak of Rs 5.

In comparison, the total value of trades in the secondary market is very small. Only a maximum of Rs 26, crore-worth trades were conducted on a single day as of March Existing customers can send in their grievances to service. No need to issue cheques by investors while subscribing to IPO.

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc.

CA is a Corporate Agent of Kotak Mahindra Old Mutual Life Insurance Ltd. We have taken reasonable measures to protect security and confidentiality of the Customer Information. Infinity IT Park, Bldg. Film City Road, A K Vaidya Marg, Malad East , Mumbai Skip to main content. Account Login Not Logged In. Trading Tools Website KEAT PRO X Kotak Stock Trader Fastlane Xtralite Dealer assisted trading Call and Trade TradeSmart Store TradeSmart Derivatives TradeSmart Insights TradeSmart Trends.

Account Types Demat Account EquityTrading Account 2 in 1 Account Trinity Account Linked Account NRI Account Foreign Investors QFI RGESS PMS Private Client Group PCG Pearl Account. Brokerage Options Dynamic Brokerage Fixed Brokerage Advance Brokerage NRI Brokerage Plans Shubh Trade Special Intra Day Features Happy Hours Trading Double or Quits. Market Indices Indian Indices Global Indices.

Futures and options expiration-day effects: The Indian evidence - Vipul - - Journal of Futures Markets - Wiley Online Library

Equities Equities Overview Gainer Loser Most Active Stocks Volume Buzzer 52Wk High 52Wk Low. Derivatives Derivatives Overview Most Active Contracts Gainers Losers Most Active Put Most Active Call Open Interest Highest in Premium Put Call Ratio Historic Data. News All News Bullion News Economic Growth Economy General Other News. Kotak Research Centre Investors Research Trader Research Mutual Fund Research Nifty Call of the Day. Sample Research Reports Fundamental Technical Derivatives Currency Derivatives.

Community Recommendations Latest Recommendations. Customer Queries Open an Account Activate an account Check Application Status FAQs. Asset Classes Trading Tools Account Types Brokerage Options. Zero maintenance charges Zero fees for demat account opening Volume based brokerage. Futures and Options contracts: What is derivatives expiry: Why it affects stock prices: Arbitrage trading on expiry: Rs 5,78, crore On an average, derivatives contracts worth Rs 2. It will take you 3 minutes to get a comprehensive perspective on financial topics.

One number fact that you should know.