Binary option pricing black scholes

black scholes - price of a "Cash-or-nothing binary call option" - Quantitative Finance Stack Exchange

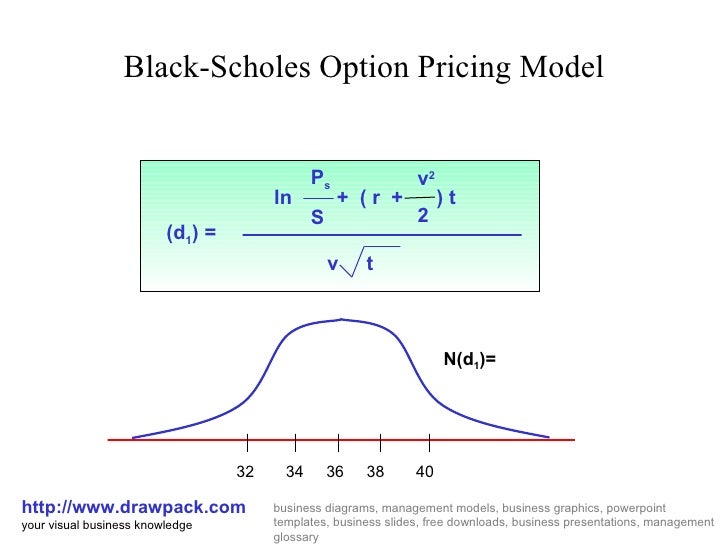

The pricing of binary options is straightforward. If you have traded options before, you may know about advanced topics like the Black-Scholes pricing model or the delta and gamma. If you know that stuff, great.

Binary options are priced between zero and How does the market form this view? A few components go into shaping the price. The higher price reflects that expectation.

Binary options black scholes # uyanilalabiwi.web.fc2.com

The odds are in the buyer's favor at that time. Conversely, if the underlying market price is lower than the strike, the probability is lower that the binary will expire in the money.

That makes the price go lower as well. The odds at that moment are in the seller's favor, not the buyer's. All binary contracts have an expiration time at which they will be worth either zero or If you have 5 hours, the probability is low.

That's because it still has a full day in which it could lose those 8 points. This is one way binary options can give you more profitable results than trading the underlying market. Watch the Nadex 5-minute binary options in forex to see this happen again and again.

We designed those 5-minute options for traders who like fast results, with the protection of defined risk. Volatile markets make bigger moves.

Black–Scholes model - Wikipedia

When markets are less volatile, these ranges tend to contract. A market that typically moves 17 points in a day might only move 6 or 8 points. The more volatility there is in the underlying market, the closer the price will be to the middle of the zero to range.

Because the market is more volatile on the second day, sellers are more averse to risk, bringing the prices closer to the middle of the range. Volatility is a factor in the binary option's price. You can also use it as a factor in your trading strategy. In such a slow-moving market, it is less likely to move 15 points that day, unless the situation changes. Of course, it always can, but the probability is greater than usual that it will stay above the strike price.

You can look at the chart to see the volatility and use that information to decide whether to take the trade. Low volatility is not hard to spot—it's when the price is meandering sideways and not moving up or down very much.

Proceed to the next course , or find much more information in our Learning Center and on our YouTube channel. North American Derivatives Exchange, Inc. Trading on Nadex involves financial risk and may not be appropriate for all investors. The information presented here is for information and educational purposes only and should not be considered an offer or solicitation to buy or sell any financial instrument on Nadex or elsewhere.

Any trading decisions that you make are solely your responsibility. Nadex instruments include forex, stock indexes, commodity futures, and economic events.

Nadex binary options and spreads can be volatile and investors risk losing their investment on any given transaction. However, the limited-risk nature of Nadex contracts ensures investors cannot lose more than the cost to enter the transaction. Nadex is subject to U. About Us Webinars Fees Funding Contact Login. Toggle navigation Open an Account.

Why Nadex Overview Regulated and Legal for US Residents Wide Range of Markets Low Trading Costs Account Types Free Practice Account Bonus Offer Binary Options Overview What Are Binary Options?

Benefits of Binary Options Why Nadex Binary Options? How to Place a Binary Options Trade Spreads Overview What are Spreads? Benefits of Spreads How to Trade Spreads Markets Overview Stock Indices Forex Commodities Events Trading Platforms Overview Nadex Trader Platform Nadex Mobile Apps Demo Trading Platform System Requirements Learning Center Educational Courses Resources News and Market Commentary FAQ Glossary Open An Account Contact Fees Funding Webinars.

Home Learning Center Educational Courses Binary Options The Components of Binary Option Pricing.

19. Black-Scholes Formula, Risk-neutral ValuationWhat is a Binary Option? The Risk and Reward Profile of Binary Options The Components of Binary Option Pricing. What factors go into the price of a binary option?

Black–Scholes model - Wikipedia

How does the binary option price reflect the probability of the option expiring in the money? Why does an option with little time remaining have a price closer to either zero or than an option with lots of time till expiration?

What is volatility and how does it affect the price of binary option? At this point you should understand: The three factors that shape the price of a binary option The way that the binary option price reflects the probability of a profitable outcome How time, volatility, and the price of the underlying market work together to affect the price of the binary option.

You've completed this course. Outline Binary Options What is a Binary Option? Market Data Position Limits Rules Legal. Holidays and Hours Notices Affiliates Site Map.