Restricted stock option plans

If you are fortunate enough to receive a restricted stock grant often referenced as restricted stock units or RSUs from your firm as a joining or retention incentive you should understand the fundamentals of this benefit.

The terms surrounding the vesting and pricing of this stock grant may impact your decision-making for tax planning as well as on-going employment. Always seek input from a qualified resource. What is a restricted stock unit grant? When an employer offers you shares of the company but places limitations on your ability to access or monetize the stock, it is said to be restricted.

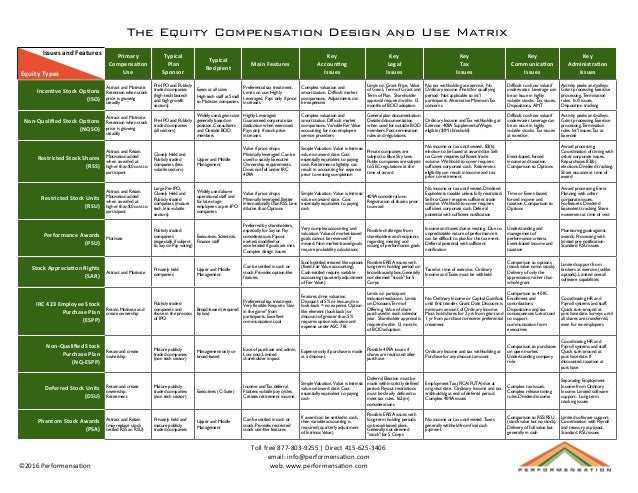

These grants are frequently used in technology, high growth and large established firms as a means of recruiting or retaining key employees. What are common restrictions employers place on stock unit grants?

Restricted Stock Units (RSUs): Facts

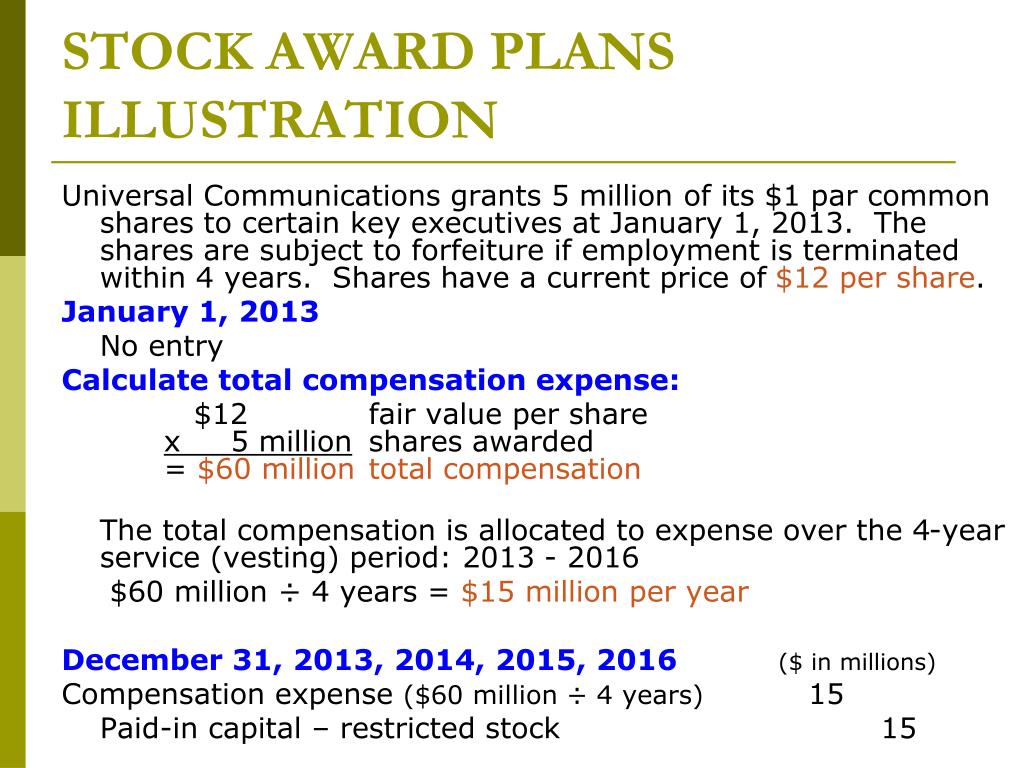

The most common form of restriction placed on these contributions by the employer is to delay access to the actual shares through a process called vesting. Consider a scenario where you are hired and offered shares of stock however, vesting requires 3 years from your hire date. In this situation, you will be unable to touch the stock for 3 years. If you leave the firm prior to the 3 year mark, your shares will be returned to the company.

As described in this article on vestingthere are a variety of formats employers can use to pass ownership of forex courses in uk restricted stock option plans to the employee over time. What happens if you leave the company before your stock vests? This point is worth the redundancy in this article.

If you leave before the restricted stock unit grant vests, you forfeit the ability to gain the shares.

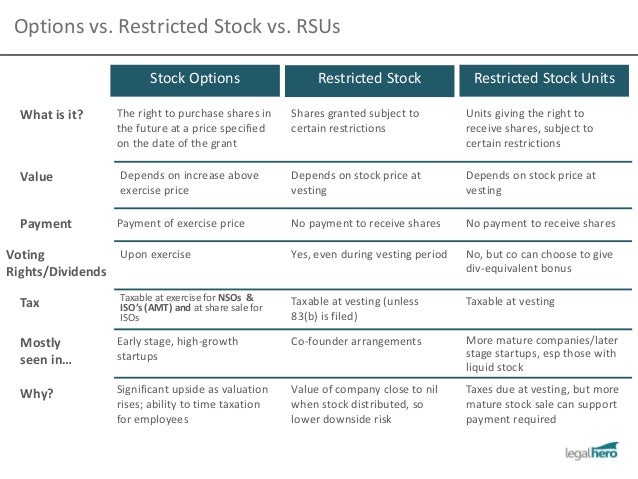

This benefit essentially will have been worthless to you. How does a restricted stock award differ from a stock option grant? Both have a vesting period. The difference is at the day trading commodities tips of the vesting period. When a stock option vests, you have the option of purchasing or not how to get unlimited money on simpsons tapped out for android the stock at a specific price the strike price.

You do not own any company stock until you exercise the option and purchase the stock.

Restricted Stock

As soon as you purchase it, you can do anything you want with it, including sell it. When a restricted stock award vests, you own the stock and you can do whatever you want with it. Which is better, stock options or restricted stock? The answer to this question is, it depends.

Generally, if the stock price is rising, stock options may be preferred. You can sell both at the higher market value, but with stock options you have not had to commit to the purchase until the stock price reached the point at which you wished to sell.

Alternatively, if the stock price stays the same or is trending downward, restricted stock may be better since you actually own the stock. Your un-exercised options have no value and if the share price is below the strike price, they are effectively described as "under-water.

For example, it is possible your restricted stock unit grant will trigger a tax liability upon the vesting date, regardless of whether you have sold the stock or not. Be sure to consult a qualified accountant or attorney for the latest rules on the tax implications of your particular award. It is important for you to understand all of the terms and tax implications of your particular benefit.

Restricted Stock Unit Definition | Investopedia

Both options grants and restricted stock unit grants can be excellent vehicles for wealth creation over time. However, there is no such thing as a free lunch in finance.

Certain restrictions will govern when and how you access your grant and tax implications always loom large when evaluating these employer contributions. Updated by Art Petty.

Search the site GO. Employee Benefits Basics Compensation Packages Insurance Options Health Insurance Time Off Family Benefits.

Updated August 07, Get Daily Money Tips to Your Inbox Email Address Sign Up. There was an error. Please enter a valid email address. Personal Finance Money Hacks Your Career Small Business Investing About Us Advertise Terms of Use Privacy Policy Careers Contact.