Settles on date stock trade

I trade pretty often. I feel like the 3 day settlement date after selling is a really big time delay, and I wanted to get some tips from people, so I can optimally trade and sell everyday. If you are using the same broker for each buy and sell order, then that broker should include any funds from a sale of shares, even if it has not settled yet.

Even though your sell order on day 1 doesn't settle until day 4, your buy order for day 2 will not settle until day 5.

So the funds from the sale on day 1 will always settle before your buy order on day 2 settles. So even though the funds from a sell order cannot be withdrawn from the account until settlement, they should still be available for trading.

Check with your broker, as this should be feasable. I think the best option is simply keeping enough free cash in your account that you can cover any buy order you want to place before the proceeds of your sell order show up in your account. One other option that I think would work for this is to use a margin account.

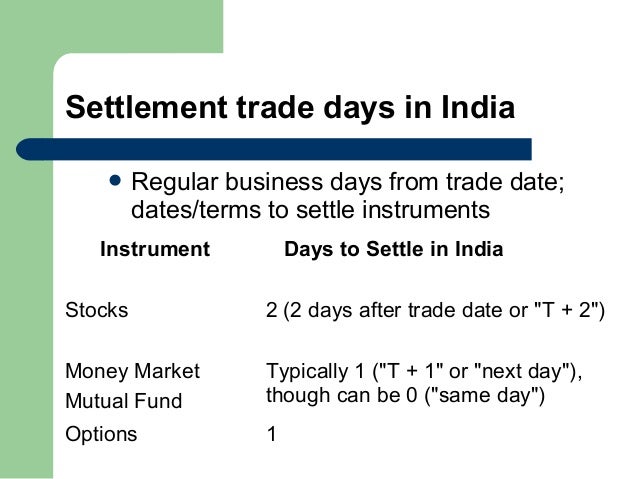

Settlement Date

You would be putting the other securities in your account up as collateral and borrowing against them. I don't like the idea of using margin accounts to heavily leverage your portfolio, but if you can discipline yourself to not borrow beyond what is on its way into your account from your sold-but-not-settled securities, I don't see a problem with it.

Stock Settlement: Why You Need to Understand the T+3 Timeline

You will want to verify that you have a margin account if you do not already. If not, and you buy with unsettled funds, your broker may deny use of the funds.

Thank you for your interest in this question. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count.

Would you like to answer one of these unanswered questions instead? By subscribing, you agree to the privacy policy and terms of service.

uyanilalabiwi.web.fc2.com | About Settling Trades In Three Days: Introducing T+3

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. For stocks, how do you keep trading when the settlement day always gets in the way? Doug 1 1 3. Yes, please elaborate how the "settlement day always gets in the way"?

Rea Jan 16 '12 at 0: The three days between the actual "sell" and the cash showing up in his account settlement means he has to wait before buying another stock, since he doesn't have cash to cover the buy. Adam - not really. You can buy with unsettled funds.

There are rules that regulate cases when you buy and sell while the funds are still unsettled, though.

Trade Dates vs. Settlement Dates: Why You Need to Know the Difference -- The Motley Fool

The really important piece of information left out here, is if you buy a position with unsettled funds, then you cannot sell that position until the funds used to buy it are settled. Adam Jaskiewicz 7 9. Chris Ballance 8.

In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3.

Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.