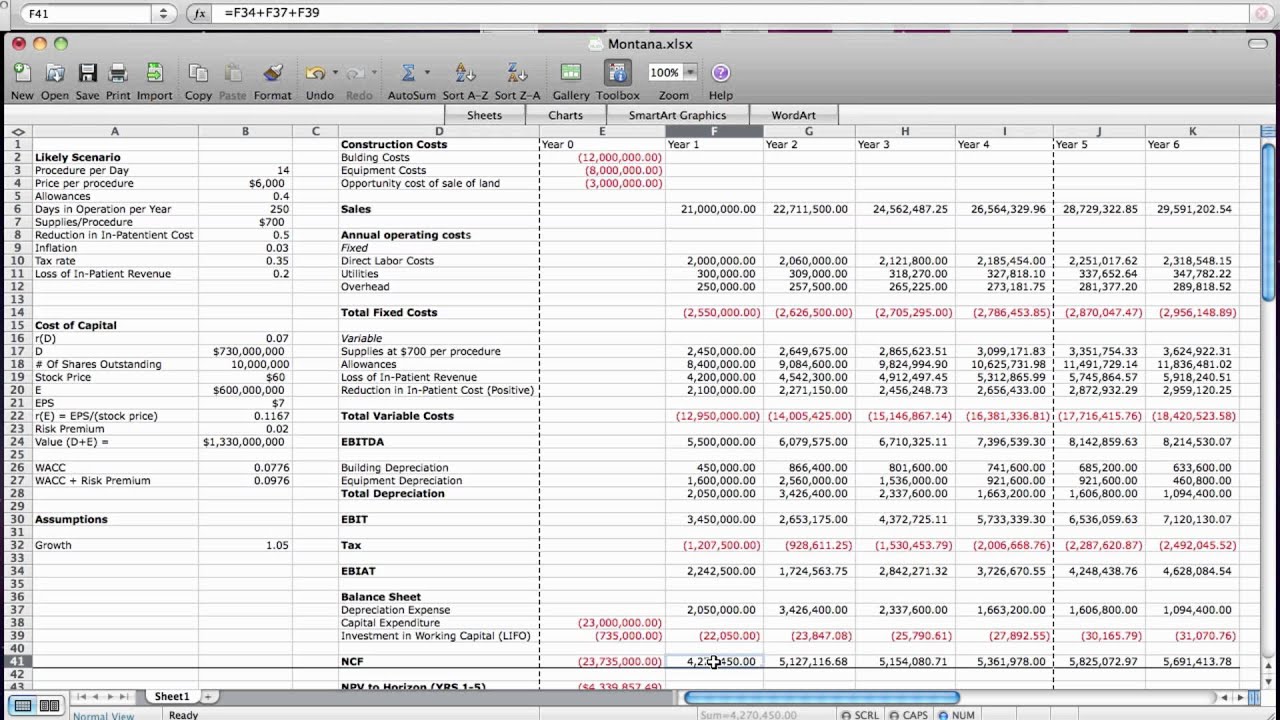

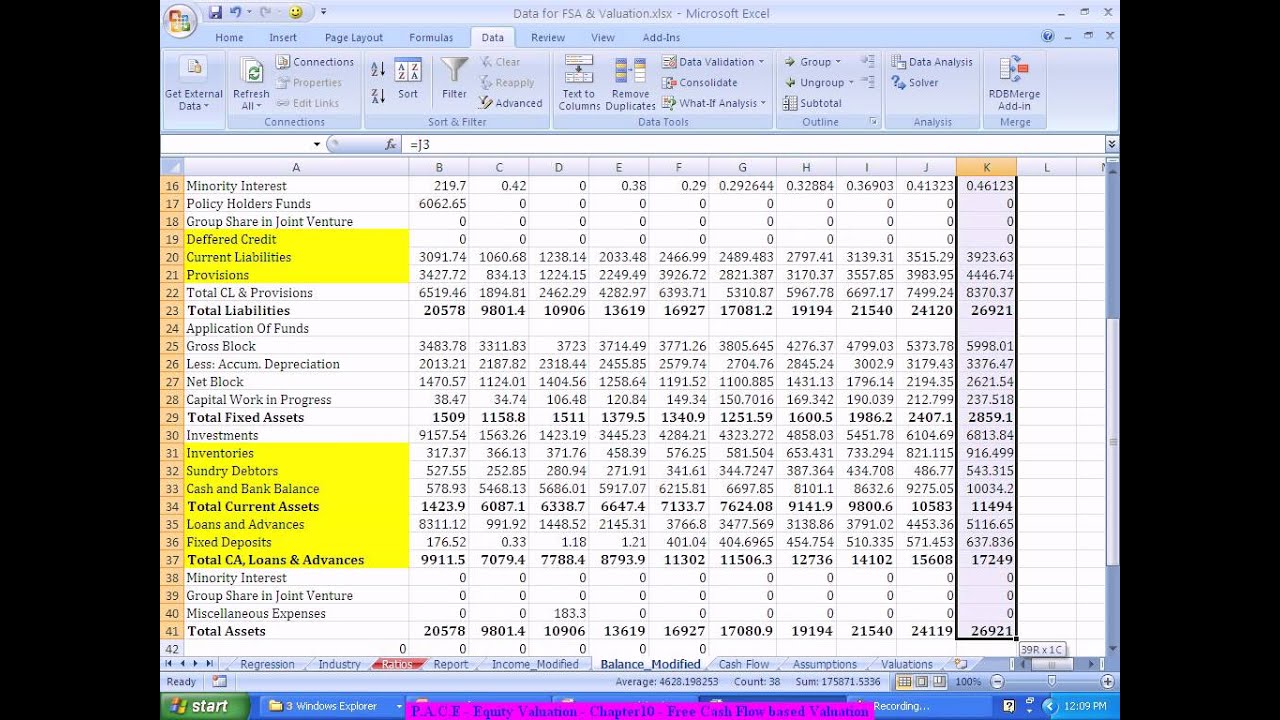

Free cash flow valuation model excel

Free cash flow FCF is used in fundamental analysis to measure the amount of cash a company generates, after accounting for its capital expenditures. To calculate a company's FCF, refer to its balance sheet and subtract its capital expenditures from its total cash flow from operating activities. For example, according to its cash flow statement as of Sept.

Spreadsheet programs

To compare the FCFs between Apple and Google in Excel, enter the words "Apple Incorporated" in cell B1 and "Google Incorporated" in cell C1. Next, enter the date "Sept. Enter "Total Cash Flow from Operating Activities" into cell A3, " Capital Expenditures " into cell A4 and "Free Cash Flow" into cell A5.

Now, enter the date "Dec. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is the formula for calculating free cash flow in Excel?

By Steven Nickolas July 15, — 1: Calculating Free Cash Flow in Excel For example, according to its cash flow statement as of Sept. Learn about the operating cash flow ratio, what it measures and how to calculate the ratio in Microsoft Excel.

Find out more about the cash ratio, what the cash ratio measures and how to calculate a company's cash ratio using Microsoft Find out more about return on equity, the formula to calculate it and how to calculate return on equity in Microsoft Excel. Find out more about the rule of 72, what the rule of 72 measures and how to calculate the rule of 72 for investments using Find out how to calculate free cash flow FCF , learn why the figure is important and examine the case of Google's FCF during Free cash flow is a great gauge of corporate health, but it's not immune to accounting trickery.

Cash in the bank is what every company strives to achieve. Find out how to determine how much a company is generating and keeping.

The metrics for the Statement of Cash Flows is best viewed over time. Review Amazon's cash flow situation, including its free cash flow yield, operating cash flow from organic growth and cash flow from debt financing.

High free cash flow yield indicates strong return for the shareholders. Tune out the accounting noise and see whether a company is generating the stuff it needs to sustain itself. A company's free cash flow for the previous 12 months. A corporate structure in which a single legal entity is comprised A valuation metric that compares a company's market price to An overall return evaluation ratio of a stock, which standardizes The process by which a firm constructs a financial representation An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

Spreadsheet programs

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.